income tax calculator indonesia

As for other taxpayers with NPWP National Taxpayer. If you wish to enter you monthly salary weekly or hourly wage then.

How To Calculate Income Tax In Excel

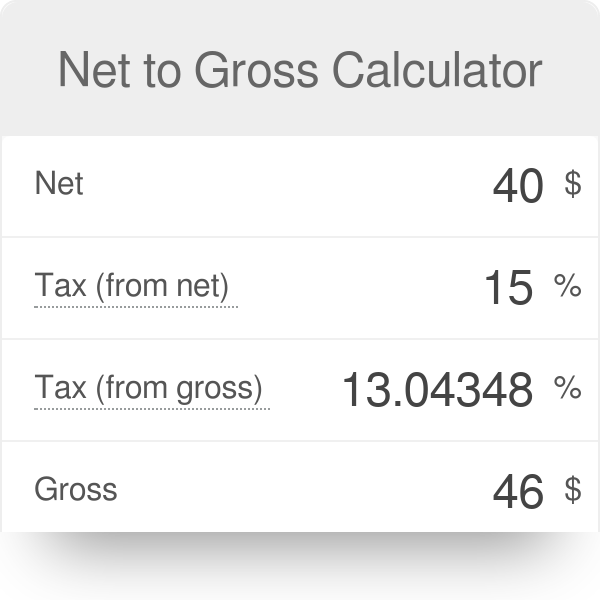

This is the amount of salary you are paid.

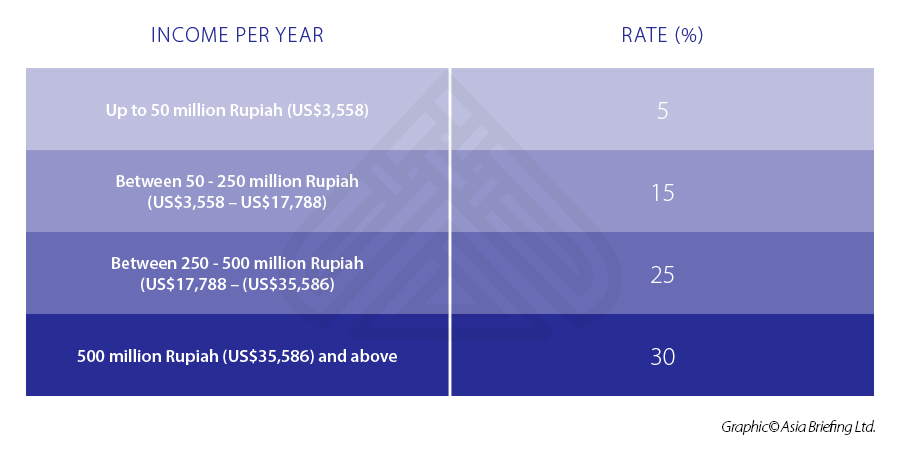

. Enter some simple questions about your situation and TaxCaster will estimate your tax refund amount or how much you may owe to the IRS. Non-resident individuals are subject to a general withholding tax WHT at 20 in respect of their Indonesian-sourced income. Income Tax Rates and.

Calculate Employee Income Tax in Indonesia. There is a wide variety of taxes in Indonesia that companies investors and individuals need to comply with. Our tax calculator stays up to date with the.

024 x 600000000 1440000. For non-resident individuals in Indonesia they are responsible for 20 withholding tax on incomes generated in Indonesia. The Tax tables below include the tax rates thresholds and allowances included in the Indonesia Tax Calculator 2022.

Premium of occupational accident protection paid by employer. Corporate Income Tax Rate. Brush up on the basics.

Premium of death insurance. The Monthly Wage Calculator is updated with the latest income tax rates in Indonesia for 2022 and is a great calculator for working out your income tax and salary after tax based on a. The Annual Wage Calculator is updated with the latest income tax rates in Indonesia for 2022 and is a great calculator for working out your.

Concessions are however available where a DTA. All companies doing business in Indonesia both locally owned and foreign owned are required to fulfill the corporate income tax obligations. We can also help you understand some of the key factors that affect your tax.

The Daily Wage Calculator is updated with the latest income tax rates in Indonesia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Daily. The Annual Wage Calculator is updated with the latest income tax rates in Indonesia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual. How to calculate import taxes simulation in Indonesia It can be a little complicated because you first need to know the HS code and search it to get the exact import duty for each.

Our free tax calculator is a great way to learn about your tax situation and plan ahead. Indonesia Residents Income Tax Tables in 2022. The Indonesia tax calculator assumes this is your annual salary before tax.

If you are S-0 for the tax year 2014 your tax exempt income becomes Rp 24300000 dan if you are M-2 in the year 2015 your tax exempt income becomes Rp 45000000.

Download Income Tax Calculator Free For Pc Ccm

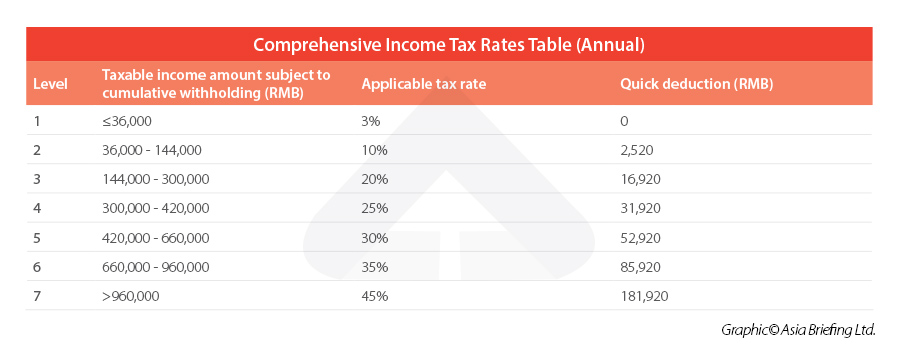

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Indonesia Taxation Of International Executives Kpmg Global

Income Tax Calculator Budget 2023 Pwc Ireland

How To Calculate Income Tax In Excel

Taxation In New Zealand Wikipedia

Simple Tax Guide For Americans In Indonesia

Personal Income Tax In Indonesia For Expatriate Workers Explained

Why Can T The Irs Just Send Americans A Refund Or A Bill

Ey 2022 Tax Calculators Rates Ey Canada

Cukai Pendapatan How To File Income Tax In Malaysia

International Tax Planning Software International Tax Calculator

German Income Tax Form Anlage Hi Res Stock Photography And Images Page 2 Alamy

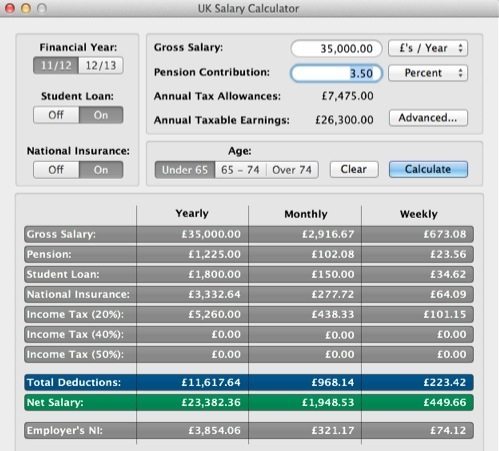

Six Apps To File Taxes On The Mac Chriswrites Com

Federal Income Tax Calculator Estimator For 2022 Taxes

China Annual One Off Bonus What Is The Income Tax Policy Change